Welcome to

Big enough to get it done, small enough to care!

Andy Mason - NMLS#: 2083131

Mortgage Loan Originator

423-302-7279

andy.mason@spmc.com

Sierra Pacific Mortgage

NMLS# 1788

www.nmlsconsumeraccess.org

My name is Andy Mason, and I am a local mortgage loan originator at Sierra Pacific Mortgage in Johnson City, TN. My family and I live in Jonesborough, TN and we love all things outdoors! I developed this website because it is my passion to guide people through one of the biggest decisions of their lives...buying a home. Being a resident of the Tri-Cities, I strive to treat my fellow residents the way I would like to be treated by providing the highest level of personalized care. It is my job to make sure your financing process goes smoothly and to ensure that you know what to expect at every step of the process. I strive to have the highest level of communication and I take great pride being available anytime (days, evenings, weekends) to answer any questions you may have about financing a home.

Sierra Pacific Mortgage is a nationwide direct lender, which means that Sierra Pacific Mortgage lends its own money. We do all of our own processing, underwriting, and servicing of loans. This is a significant advantage for you since it translates into a very smooth lending process from beginning to end!

Your Guide to Financing a Home

Step 1

Prequalification

Prequalification simply means that your credit score, debt-to-income ratio, and your assets have been assessed according what you have declared. Upon initial analysis, you are deemed to potentially qualify for a mortgage within the parameters of your prequalification letter. Prequalification can take only 15-20 minutes over the phone. See more about minimum credit scores and debt-to-income ratios below.

Step 2

excellent realtor:

Just like every other profession, not all realtors are the same! There are some with distinct qualities that others just don’t have. Over my time in this industry, I have met realtors that have been proven to show certain qualities that make them excellent at what they do. It would be a great pleasure for me to connect you with one of these realtors. See below for what separates an excellent realtor from just a good realtor. It is important that we supply your realtor with your prequalification letter so that he or she knows what you are approved for as well as any other stipulations that need to be made within your offer.

Step 3

Find your home and make an offer:

At this point, you, your realtor, and I will have developed a good strategy for you to make an offer on a home. When you attach your prequalifiaction letter with your purchase agreement, it helps you make a strong offer compared to other potential buyers who are not prequalified. Be sure to make an offer within the parameters of your prequalification letter and any stipulations that came with your prequalification letter.

Step 4

Offer is accepted!

Congratulations! In the real estate world, this is the time that is referred to as being “under contract”. This is a very important time in the process of obtaining a home. It is important for you to be sure to listen to my guidance and the guidance of your realtor to do certain steps, to meet any specific timelines within your contract, and/or gather other needed documentation.

Step 5

Submit documents:

At this point, we need to verify your income and assets. Some of the documents you will need to submit are:

- Copy of Driver's License

- Recent two years of W-2's or tax returns (if self-employed)

- Most recent paystubs (30 days worth)

- Two months of bank statements

I have a expert loan processor who works on every loan file to ensure everything is prepared for an underwriter to review. Typically, there are other conditions that need to be met or completed in order to meet certain mortgage regulations. My loan processor will communicate with you about what may be needed.

Step 6

Don’t make any changes!

This is SO important! Remember that, at this point, you are pre-approved for your mortgage based off of a specific credit score and debt-to-income ratio. Now is not the time to make big financial purchases or decisions that would affect your credit score or debt-to-income ratio. Make sure you do the following things:

- Keep making all payments on all of your lines of credit.

- Don’t quit or change employment status.

- Don’t take out any new credit lines (car payment or lease, personal loan, etc.)

- Save as much as you can with every paycheck.

Step 7

CLOSING TIME!

YOU did it! Now it's time to start celebrating! You will need your ID and a well-rested signing hand at closing!

Congratulations!!

Sierra Pacific Mortgage has the ability to do a fully underwritten preapproval PRIOR to you making an offer on a home. Not all lenders have the ability to do this. This means that our underwriters will verify your details upfront. When you make an offer having completed this legwork first, this makes your offer to purchase carry more weight than just being prequalified! Basically, you are doing Step 5 prior to Step 3.

More on Prequalification, Debt-to-income ratios, and Credit Scores

Prequalification means that your monthly debt and monthly income (debt-to-income ratio), credit score/history, and your assets (money you have sitting in bank accounts), have all been assessed and you are deemed to potentially qualify for a mortgage. Once you are prequalifed, you will receive a formal prequalifcaiton letter and a fee worksheet showing estimated closing costs and estimated monthly payment including principal, interest, taxes, and insurance (PITI).

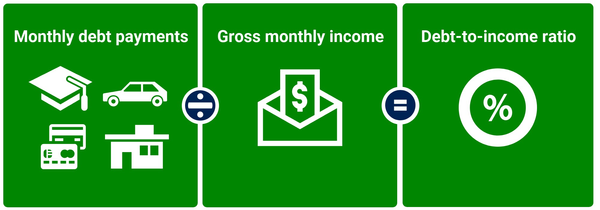

Your debt-to-income ratio (DTI) is a percentage. Different loan types have different debt-to-income limits.

Mortgage lenders are bound by regulations which restrict our ability to lend if a borrowers DTI is too high. These regulations are in place to ensure that someone has the ability to repay the loan.

A credit score is an indication of one's trustworthiness with borrowed money. Unfortunately, credit scores can be quick to fall and slow to rise.

Typically, the minimum credit score to obtain a mortgage is 620 however some mortgage products require a minimum of 640. We pull credit from three credit bureaus, and we use the middle of the three scores.

Frequently Asked Questions...

When you are ready, let's talk about these questions.

How low of a downpayment can I make?

Can I get downpayment and closing cost assistance?

Can I have the seller pay to lower my interest rate?

As a first-time home buyer, what advantages do I have?

What if the appraisal comes in lower than my purchase price?

What is a seller concession and how can that help me?

Can I get a mortgage if I had a bankruptcy in the past?

How much should I expect to pay in closing costs?

When do I lock my interest rate?

What is an escrow account?

What separates an excellent realtor from just a good realtor??

A excellent realtor WILL:

- Be an expert communicator.

- Listen to your desires.

- Advocate for YOU and your desires at all times.

- Treat you the way he/she would like to be treated.

- Be a strong negotiator for the best deal for YOU.

- Be honest at all times and have the highest integrity.

- Have great attention to detail.

- Educate you about the current housing market.

Over my time in this business, I have come to know MANY realtors.

I would be happy to connect you with a solid realtor who has these qualities.

Verified customer reviews from Experience.com

Andy was available any day of the week that I had a question. I had bought a house with another lender before, but after using Sierra Pacific and having Andy work our loan, I would never use another lender.

-Jonathan N., Client

Working with Andy has been fantastic...His professionalism allowed my buyers to have a seamless and wonderful experience from beginning to end!

-Luis H., Realtor with Southbound Real Estate.

Andy is a very personable gentleman who is easy to reach and gets back to the customer in a timely manner.

-Paul L., Client

Andy was great! He was always willing to answer any questions, and as first-time home buyers, we had lots of those! We really appreciate his help!

-Cindy and Matt W., Clients

Andy has shown me over the years what it looks like to be a true Christian professional in today's real estate environment. He upholds a very high standard of integrity and work ethic that shows how much he cares about his clients and peers.

-James S., Realtor with

Keller Williams

Andy was there to answer any questions we had and he went above and beyond to ensure we were taken care of in the best way possible. As a first time homebuyer, he made the process a lot less scary!

-Carly and Noah R., Client

Great service! Cleared to close a week early so it wasn’t a mad scramble!

-Dustin J., Client

I will be straight with you...nobody else is getting out closing disclosure packages as easily as Sierra Pacific. Takes a ton of pressure off everyone involved!

-Corey L., Classic Title

Throughout the borrowing process, Andy was knowledgeable, communicated efficiently and effectively, and did so while always remaining kind and with energy. We could not have asked for a better loan originator for our first home!

-Adam and Erin B., Clients

Let’s Navigate this journey together!

Andy Mason - NMLS#: 2083131

Mortgage Loan Originator

Awards

Meet in person at my office

Call or text me to set

up an appointment.

2726 E. Oakland Ave. Suite 107

Johnson City, TN 37601

Call or Text

I am available days, evenings, and weekends!

Remember, Prequalification can take only 15-30 minutes over the phone

423-302-7279

andy.mason@spmc.com

Licensing

© Andy Mason - NMLS #: 2083131. Sierra Pacific Mortgage Company, Inc. NMLS#: 1788. (www.nmlsconsumeraccess.org) Equal Housing Lender. 950 Glenn Drive, Suite 150, Folsom, CA 95630. This is not a commitment to lend. Not all borrowers will qualify. Rates and terms are subject to change at any time.